HOW TO DEVELOP FINANCIAL LITERACY?

August 30, 2019

HURDLES THAT STOP US FROM CREATING WEALTH!

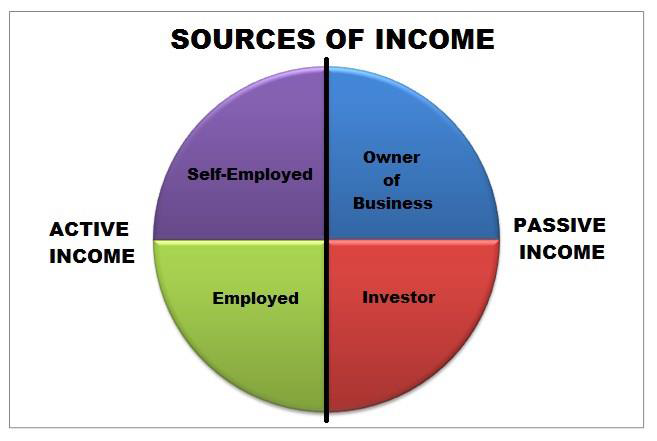

August 30, 2019HOW TO DEVELOP MULTIPLE SOURCES OF INCOME?

Each person gets income from different sources at varying proportion. The highest contributor of

income to the kitty is called Primary income source. Then comes Secondary sources, followed by

Tertiary sources.

PRIMARY SOURCES

Salaries for those employed people irrespective of rank or position.

Consultation fees for Doctors, Physiotherapists or Radiologist

Professional fees of Chartered Accountants, Company secretaries and lawyers.

Service fees like Architects, Engineers and Laboratory service

Service fees of personal services like Barbers, beauticians and tailors

Wages like paid to Electricians, Plumbers and workers

Trading income like commodity traders, shop keepers and owners of department stores

Commissions or brokerages earned by Insurance agents, Real estate broker and share brokers

Primary income is generally 60-95% of the total income.

SECONDARY INCOME

A Doctor can earn a salary by working in a Hospital and in the evening, he may do private practice and earn consultation fees.

A person can earn salary by working in an office, but can add additional income by selling mutual fund or insurance products or working as a property broker.

The additional income earned is called secondary income.

The secondary income could be less than 50% of the total income.

TERTIARY INCOME

If a person can add further income by investing in other sources as follows:

-Income from interest on deposits with Banks and Companies.

-Income from rental properties- residential or commercial

-Income from business as a sleeping partner or as an investor

-Earns income from Company shares through dividends.

– Income by being a blog writer or conducting classes in an institute during weekends.

The tertiary income could be less than 20% of the total income.

FOURTH /FIFTH INCOME SOURCE

There are many smart people who gets income from fourth or fifth source. The sources of income and its contribution to overall kitty will vary from person to person.

DERISKING INCOME SOURCES

A person can reduce his income risk by adding more sources of income over time. As one progresses

in age, one should try to reduce risk by depending on only one source of income. An example could

be as follows.

| Age | Primary % | Secondary % | Tertiary % | Fourth/fifth% |

| 25 | 100 | – | ||

| 40 | 90 | 10 | ||

| 50 | 75 | 20 | 5 | |

| 60 | 20 | 35 | 25 | 20 |

DEVELOPING ALTERNATE SOURCES OF INCOME

Developing alternate sources of income depends on many factors: If you are working at a senior level in corporates, developing such sources will be difficult, either because under contract you can not do any other activity or you are too “famous” to do anything else.In this case, you can take up part time teaching jobs, silent partnership in firms etc If your spouse is educated, he/she can developed to do part time or even full time jobs. Developing alternate source will depend on variety of factors which includes education level, skill set, physical energy level, legality , the place that you stay and so on.

HOW MUCH INCOME DO YOU NEED?

This is to be answered by each person as it involves personal expectations, habits, place that you live, how many members of the family, Whether you have own house or rented and financial commitment for members of the family .What one person thinks as luxury may be looked at “essential” for another person. Example- AC at home is a luxury for one person whereas another person looks at it as “essential”. Getting a bottled water by a person in a Metro is considered essential whereas a person located in a small town looks at as luxury. For most people sources of income are fixed, whereas the avenues for spending are many. One can even discover new avenues to spend. Let us look at types of expenses for a middle-class home.

| House Rent | Medical expenses |

| Food related households’ expenses | Social expenses

(Marriages, Birthdays) |

| Utility expenses- Electricity, Water, Gas, TV, Phone bills, Internet, Mobile bills, | Entertainment

(Movies, Shows, picnics, Eating out, personal, cloths) |

| Support staff-

Servant, Gardener and Cook |

Personal clothing |

| Children education -Fees, Books, Tuition, transportation and uniforms | Knowledge update –

Newspapers, magazines and books |

| Furnishing of house | |

| Vehicle repair and petrol bills | |

| Building maintenance | |

| Apartment Maintenance charges |

IMPORTANT TIPS

• Saved income as Deposits and investments in appreciating assets are not expenses.

• Investments in to non-appreciating expenses must be treated as expenses.

Example: Loan interest paid for housing loan can not entirely treated as an expense. But, loan

interest paid for a car has to be treated as 100% expense as the value of asset falls over time.

However, both expenses must figure in monthly calculations for monthly budget assessment