STRATEGIES TO BEAT INFLATION BY PHARMA SALES GUYS

WEALTH AND INCOME PARADOX

August 30, 2019

WHY MANY PHARMA SALES GUYS ARE FINANCIAL ILLITERATES?

September 10, 2019STRATEGIES TO BEAT INFLATION BY PHARMA SALES GUYS

I spent over 30 years in the Pharma industry, starting off as MR .I always had soft corner for the sales guy, be it is a MR , ASM, RSM or someone senior.

I worked in the industry when talking about salary or applying for a leave was considered a sin. Keep talking about target, sales closing, Doctor, Stockist and call average, but never taboo subjects like investments and taking your wife for a movie.May be things have changed now.

But, I was a bit different. I talked how a RSM can own a car when very few had cars.I talked about owning two flats with my NSMs.I accompanied few to housing loan companies, cajoling them to take housing loan.I insisted that 100% of sales guys must have at least a Diploma in Management. This approach paid off. My Companies performed far better than competition without using BC/MC words to anyone.

Your income level is certainly an influencing factor about the future state of your wealth. However, even more influencing factor would be how you save and how you invest your savings. A MR/ASM can overtake RSM/ZSM in terms of wealth in about 15-20 years if right investment avenues are chosen. The smartness lies in becoming ‘money smart’ through financial literacy.

I am not in the industry anymore. But, my heart tells me to write few articles for old time sake. I am not suggesting serious revision of salaries for anyone, but urge you to learn to invest wisely. This article is dedicated all Pharma sales guys.

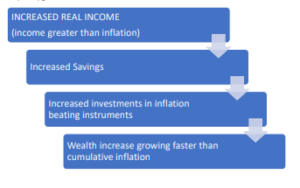

What is real income?

Real income refers to the income of an individual after taking into consideration the effects of inflation on purchasing power, For example if you receive salary income goes up by 10% and the inflation for the year is 7% then the real income only increases by 3%, conversely if you receive 7% salary increase and the inflation was 9% then the real income shrank by 2%

Inflation and CPI [Consumer Price Index]

Inflation is the rate at which the general level of prices of goods and services are rising and consequently the purchasing power of currency is falling.

The CPI measures the average cost of basket of goods – food items, medicines and medical care, clothing, transportation, entertainment, education etc, which is published on monthly basis.

WHAT ARE THE EFFECTS OF INFLATION ON LIFE AND INVESTMENTS?

Inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. When the general price last rises, each unit of the currency buys fewer goods and services. Consequently, inflation reflects on the purchasing power of a unit of money -a loss of real value in the medium of exchange and unit of account within the economy. One can get consumer price index over time from which one can understand the rate of inflation.

WHAT ARE THE EFFECTS OF INFLATION ON YOUR SAVINGS AND RETURN ON INVESTMENTS?

Let us look at three Scenarios of Inflation vs Return on investments.

• If inflation is 7 % and return on your investment is 7 % the inflation adjusted return is zero. You have retained value of your capital.

• If inflation is 9 % and return on your investment is 8 % the inflation adjusted return is 1 %, though you got a higher return.

• If the inflation is 4 % and return in your investment is 7 % the inflation adjusted return is +3 %, meaning you have added wealth.

GOALS OF INVESTMENT

The primary goal of investment is to beat inflation and create wealth.

WHAT STRATEGIES CAN YOU DEPLOY TO BEAT INFLATION?

The key to beat inflation is to plan investments in instruments which will grow faster than inflation.

However, each of these have its advantages and disadvantages. Each has different risk vs return profile. Unless you evaluate each one in the context of your strength and weakness, you must not opt for it.

[A] DIVERSIFY – PORTFOLIO / GEOGRAPHY / ASSET CLASS

One of the best ways to protect against inflation is to diversify investments. Geographically for real estate, asset class wise (gold / equity / real estate) or portfolio (Multi cap / mid Cap/small cap].All asset classes do not grow similarly. Hence diversification is an important strategy to beat inflation

[B] IMPROVE CURRENT INCOME

Earn current income greater than current inflation. If current inflation is 6%, you need to get yearly salary increase greater than 6%. This can be done by the following methods.

*Perform better at the current job and be eligible to earn higher than inflation wages

*Shift to a better performing company to earn wages higher than inflation

*Take up a higher position which can pay better

*Shift geographical location, ie: a place where better wages are possible

*Learn new skill levels or add education to improve chances to increase income

*Opt for multiple sources of income- may be rental, dividend, part time job etc

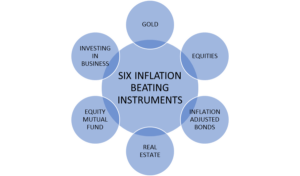

[C]INVEST IN SIX INFLATING BEATING AVENUES/ASSETS.

1] REAL ESTATE INVESTMENTS

Real estate is considered a good hedge against inflation on long term basis-7-10 years. If it is an income generating real estate like rented house or shop, it is even better.

2] START A BUSINESS

If successful, most businesses will give returns much higher than inflation. All businesses have inherent risks associated with it. You need to have the following among many other,

-High commercial skills- Purchasing, marketing, Sales and so on.

-Ability build partnerships and relationships, meaning high EQ skills.

-Leadership and managerial skills

-Emotional stability, particularly mental balance to withstand failures and long waiting.

-Capital or ability to raise capitaletc

With great demand of skills, technical understanding and emotional maturity, all are not ciut out for this.

3]INVEST IN EQUITY

If you can not own a business, the next best things to do is to own equities which in effect means “owning business” in a little or micro way.You get appreciation of invested money on long term basis and get regular dividend income along with the Directors of the Company. Investing in equities (growth stocks) is one of the best ways to stay ahead of inflation. Over the past 10 years NIFTY has returned close to 17% a year compared to 5- 7% average inflation rate.

But investing directly in shares is risky for 90% of the people as this requires similar skills like starting a business. If you are not cut out to start a business, you are certainly not cut out to directly invest in shares.

4]INVEST IN MUTUAL FUNDS

For all small investors and large investors who do not have time or expert advice, it is advisable to go for mutual fund route. Investing in mutual fund is as good as owning shares of leading, successful Companies.The only difference being, your investments are handled by a professional fund Manager.Invariably, this fund manager is far more qualified and experienced than you.If you apply for a fund managers job, you may not even get called for interview.But, you are able to get services of such a smart guy! To reduce risk, you can opt for SIP route, instead of lumpsum investments.

5]GOLD INVESTMENTS

Gold is considered an ideal hedge against inflation. Gold will not give recurring income like dividends from shares, but on long term basis [10-20 Years] gold can beat inflation, subject to you selecting right type of Gold. I am not talking about Gold ornaments, but, Non Physical gold including E Gold.

6] INFLATION ADJUSTED BONDS

RBI has issued IIBs (inflation indexed bonds). These bonds protect the principal against inflation. This is a good idea if you trust only RBI and are not interested in learning about other inflating instruments. Essentially, there are six opportunities to get income or generate wealth faster than inflation. It is important to note that your age, life goals and risk appetite will decide the asset class mix. It is similar to recommending food to people of different ages and levels of health. If you are on the wrong side of 50 and diabetic, I will suggest less sugar and fat. Similarly, I will recommend less of equity and high equity based mutual funds.

SIX INFLATION BEATING INSTRUMENTS

Every return on investment must be looked at through the prism of ‘’inflation adjustment’’

THE ART OF WEALTH CREATION IS CONSISTENTLY ADDING HIGHEST” INFLATION ADJUSTED RETURN “TO INVESTMENTS MADE.

This blog is written by Simon Daniel, a double postgraduate in management sciences, Ex CEO and Director of leading Pharma/Healthcare Companies with 30 years + track record.

Under his leadership, around eight Pharma SBU’s were created .He took part in creating more than one dozen top IMS brands. Out of close to 12,000 people who worked in his teams, more than 100 have reached positions like GM/VP/DIRECTOR .

He has established two successful start ups too. In Quora [www.quora.com] , he went on to become World No.1 writer in Personal finance advice and investing advice topics, being called a “personal finance guru”

He is the author of highly acclaimed book titled:

ALL ABOUT MONEY BECOME MONEY SMART!

The book is a comprehensive guide to saving, investing, spending, borrowing and protecting-the

five key financial literacy competencies essential for all people.

Book is sold in all leading online stores in India and globally. It is sold through Author’s website www.simondaniel.in

Also sold in www.amazon.in and www.flipkart.com