MIS- SELLING OF MUTUAL FUNDS

August 30, 2019

STRATEGIES TO BEAT INFLATION BY PHARMA SALES GUYS

September 10, 2019WEALTH AND INCOME PARADOX

Someone can be wealthy and terribly unhappy. Someone may be wealthy without liquid money to spend when in need!

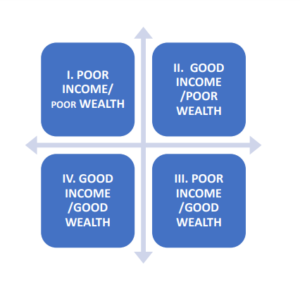

FOUR TYPES OF WEALTH OWNERS

GROUP -1- CRISIS STATE INCOME

If your income is less then expenses, you are in a state of financial crisis. To survive, you have the following options:

Increase income suddenly- This is almost impossible unless you get in to crime! Cut down expenses- This can be done almost immediately, particularly, the nonessential. Borrow if you have assets like Gold or Bank deposits from private parties or NBFC or Banks Sell assets- if you have assets!

[Some assets are impossible to sell on short term basis

GROUP -1- STRATEGY

• Take up income generating job

• Switch over to high income job

• Encourage spouse to take up full/part time job

• Do not use any credit card

• Try selling some assets.

The objective of strategy is to end up with at least 10 % of your income as savings

GROUP -2- SURVIVAL STATE INCOME

This is the financial state wherein an individual survives as good as on day to day basis. At the end of

day or end of the month, if his/her savings are much less than 10% of the income, it can be

considered a survival state.

The best option available for the individual is to cut non-essential expenses and increase savings to

10% or higher.

GROUP -2- STRATEGY

-Evaluate expenses and look at ,what expenses can be curtailed or totally stopped.

-Explore getting higher paying job

-Encourage spouse to take up full/ part time job

-The objective in to reach income state of at least 10% savings of the income

GROUP -3- WEALTH CREATION STATE OF INCOME

This is a healthy financial state wherein an individual save 10-20% of the total income. The individual can now focus on creating long term wealth for self and family by deploying the saved amount in appropriate assets. This book is meant for those who are in this wealth creation state.

GROUP -3- STRATEGY

This group needs to study investment avenues and carefully plan investments.

It is worthwhile spending Rs-1000-3000 per year on the following

– Attend investment /personal finance training courses

– Read few books and journals on investments

– Subscribe to a personal finance online journals.

– Subscribe to Finance newspapers

– Consult CA’s and CFP’s

– You need to have a software or tracking mechanism for all your investments and wealth.

[There are many online software are available FREE.

Example : Money ControlORValueresearch Online

Remember!

• Do not make investment decision simply based on advice given by friends, relatives and

colleagues.

• Do not make investment decisions based on newspaper headlines

(Examples: “SENSEX ZOOMS PAST 11000!, INVESTORS DANCE IN DALAL STREET!AMBANI ADDS 50,000 CRORES WEALTH!] • Do not take an investment decision because someone else made great success.

GROUP -4- WEALTHY/RICH INCOME

If your savings are more than 20% of income, and if it runs in to millions, you have the potential to be among top 5-10% of the Indian population in terms of wealth. In such an income state, you need to plan and manage your wealth with professional help. Wealth management has to be done by allocating or reallocating wealth under different asset classes based on the growth potential at different phases of your life while looking at various economic opportunities that come up.

GROUP -4-STRATEGY

*You need to have a software or tracking mechanism for all your investments and wealth.

*You must have the services of CA on annual retainer basis

– to file your Income Tax returns and

– take care of wealth tax and capital gains tax.

-You must have proper book keeping for audit purpose.

*You may need services of a CFP to plan your investments and wealth.

* You may need the services of a good lawyer to protect by drafting various finance documents.

*You need to study and plan your investment decisions carefully while taking in to account return on investments and tax implications.

*Need to have a clearly laid up asset allocation plan in term of real estate /equity /debt/ tax saving investment etc.

*You need to protect your asset with the help of various insurance plan

INCOME /WEALTH PARADOX

Income and wealth are paradoxical at times as shown in these examples. And, a person can figure in

any of above matrix based on his income vs wealth.

Example 1: HIGH WEALTH IS NOT A GUARANTEE FOR HIGH INCOME!

Thereis a lady who has inherited Rs20crores worth of plot in the middle of the city after her husband’s death but she lives on monthly pension of Rs 10,000/- .She finds it difficult to pay property tax and go for medical treatment

EXAMPLE 2: HIGH INCOME IS NO GURANTEE FOR WEALTH OR ABILITY TO MEET EMERGENCIES.

This young man passed out of leading institute and he is on salary bracket of 20 lakhs PA .He has no assets and even his fancy car is on EMI. He lives in posh locality with monthly rent of Rs. 70,000 /. He is newly married and lives life to fullest and has less Rs 1 lac bank balance. He has life insurance worth Rs 5 lacs and medical insurance of Rs 2 lacs.

What if he meets a deadly road accident? How will his wife handle it? What if he dies suddenly? What will he leave behind? And what will his wife do?

WEALTH LIQUIDITY

Wealth can be broadly classified as liquid /semi liquid /poorly liquid. These classifications are not” cast in stone”, but few variations and exceptions are possible.

LIQUID

• Cash in SB A/c

• Cash in Hand

SEMI LIQUID

• PPF

• Gold/ Silver

• Insurance Policies

• Bank FD/ Liquid fund

LOW LIQUIDITY

• Houses/ Plots

• Agri land/Comm bldg

FLUCTUATION

• Mutual Fund

• Shares