COMMON TYPES OF INVESTMENT SCAMS

August 30, 2019

The world of finance, investments and wealth management are filled with illiterates, crooks, frauds,and scoundrels. If you are not alert at all times, you will lose your money wherever you store.

Stillworse, you may end up giving up your money and assets willingly, without any trace of violence! Youmay realise your loss only after few months or even years. After losing your wealth you may not talk

about it to anyone. And least of all, to police!Well, that’s the way crooks extract money out of you. Very smoothly. Cunningly and unknowingly.Why are people so gullible”?

First, let us look at how to become rich.

Or how to earn income higher than inflation? How to create wealth greater than cumulativeinflation?

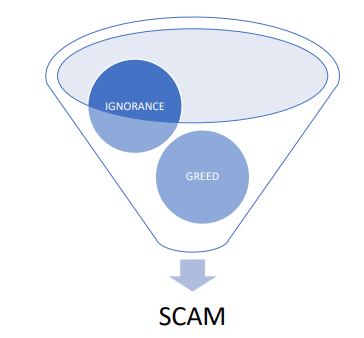

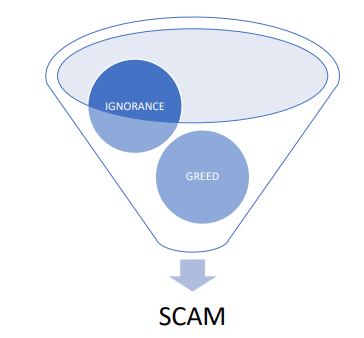

Ignorance and greed are the root cause of all scams

The root cause of all investment scams is ignorance and or greed. A combination can make it worse.

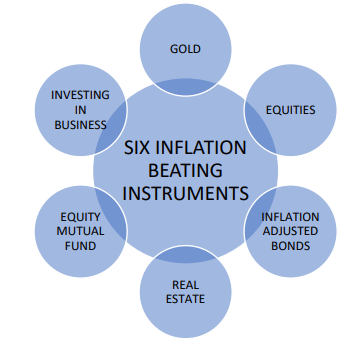

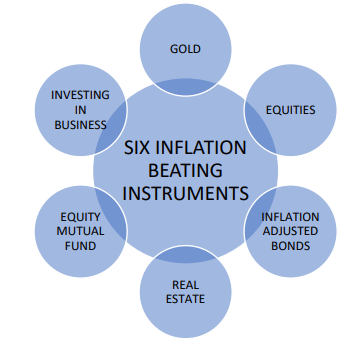

Investment avenues like fixed income which could give income around inflation rates only. Almost allfixed income investments offer returns around 7-8% PA . If inflation is around 6%, Post Tax, veryoften returns may be little lesser than inflation! Investing in to fixed income generating instruments /assets can never make you rich! Essentially, there are six opportunities to get income or generate wealth faster than inflation.

SIX INFLATION BEATING INSTRUMENTS

in all investment scams ,frauds crooks and scoundrels offer you return on investments far greater

these opportunities. Because you are ignorant you listen to them. Because you are greedy, you not only listen, you act on the baits offered.

COMMON TYPES OF INVESTMENTS SCAMS

Investment scams usually involve getting you to put up money for a questionable investment or one that does not exist at all. In most cases you will lose some or all of your money.

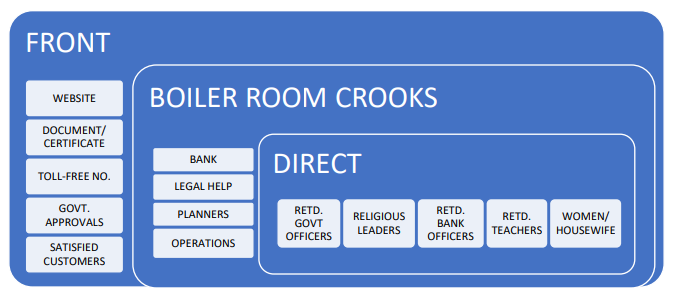

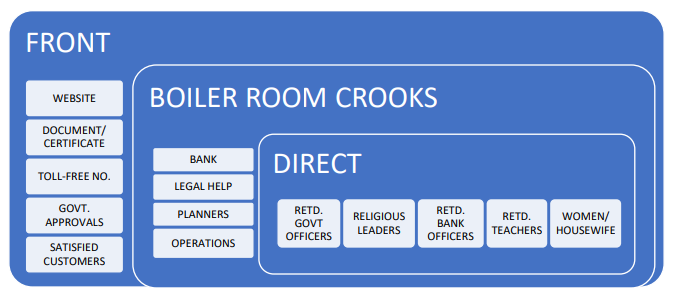

Every scam is operated by a group of “smart crooks”. It is often operated from make shift office

called “boiler room”. To convince you that the company or its activities are real, it may have an elaborate FRONT which consist of websites, certificates, Approvals, Toll free nos., satisfied customer’s photos and so on .Their address will be in a posh locality of a Metro city. Often they will have a sweet talking Lady Executive. English, for sure!

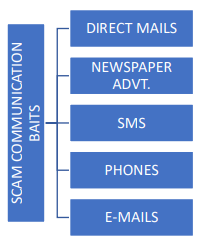

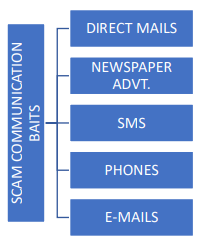

It will also have directcontact people ,usually innocent employees. Crooks prefer retired govt or Banks officers, Teachers, religious leaders etc, who are known for integrity and good community name. They use communication baits – consists of direct mail, news paperAdvt, printed notices,billboard notices, brochures, SMS, phones and Email. Violence or threat is never used to extract money. They use smooth talk and great promises. They put up a show that you are one of the many clients that they have and they are not very eager to have you in. Their stories are so credible looking that you may visit their office and hand over cheque.

SCAM INFRASTRUCTURE

By the time you have realised that you lost your money it is too late. They would have shifted to

another scam in another city.

This blog is written by Simon Daniel, a double postgraduate in management sciences, Ex CEO and Director of leading Companies with 35 years track record .He has established two successful start ups too. In Quora [www.quora.com] , he went on to become World No.1 writer in Personal finance advice and investing advice topics, being called a “personal finance guru”

He is the author of highly acclaimed book titled:

ALL ABOUT MONEY BECOME MONEY SMART!

The book is a comprehensive guide to saving, investing, spending, borrowing and protecting-thefive key financial literacy competencies essential for all people.

Book is sold in all leading online stores in India and globally. It is sold through Author’s website Simon Daniel And All So Amazon or Flipkart